How Solenyrix Token Connects Renewable Energy, High-Performance Compute, and Green DeFi Infrastructure

Blockchain technology and artificial intelligence have transformed entire industries, but both face a common criticism: massive energy consumption and significant carbon footprints. Bitcoin mining, proof-of-work consensus, and high-performance AI compute clusters collectively consume energy rivaling small nations, often powered by fossil fuels . Meanwhile, renewable energy projects—solar farms, wind parks, and hydroelectric installations—struggle with unstable cash flows, underutilized capacity, and difficulty securing financing despite their environmental benefits.

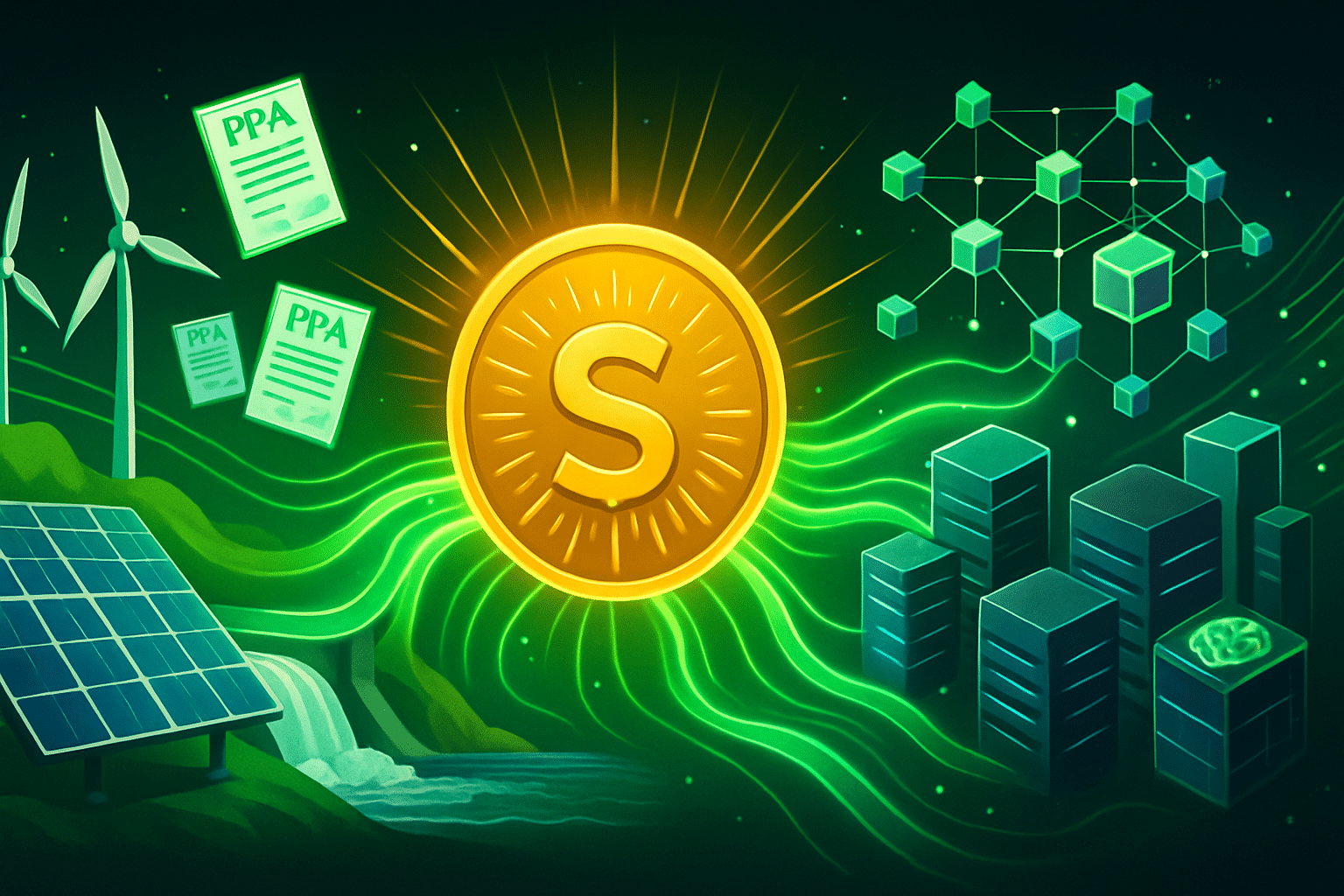

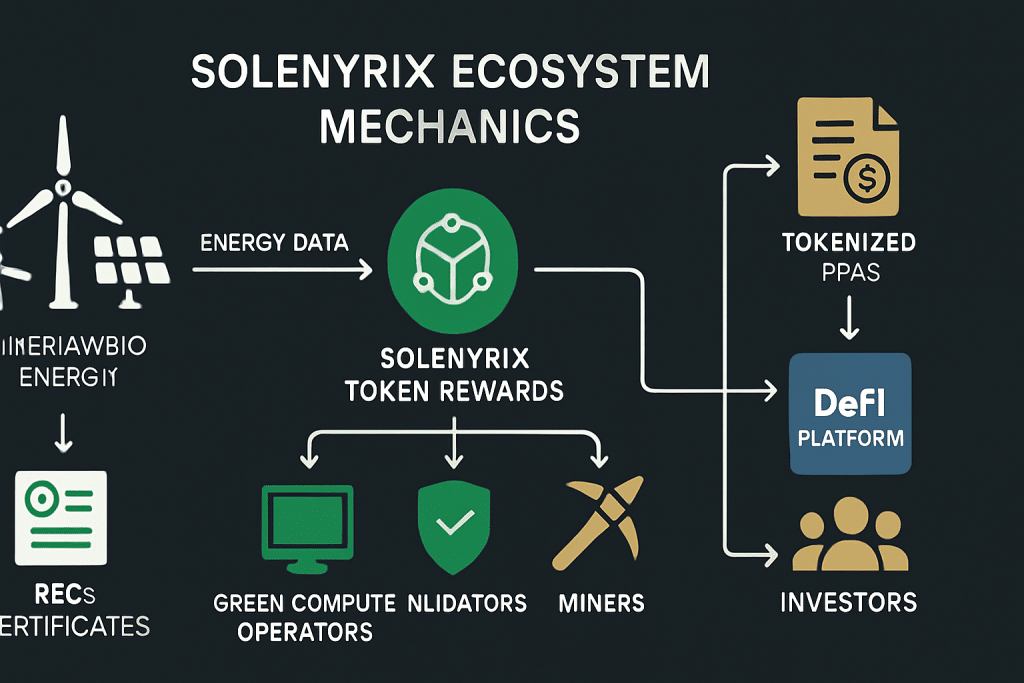

Solenyrix Token proposes a solution that bridges these two challenges: a protocol that economically incentivizes blockchain nodes, validators, miners, and AI compute operators to preferentially use verified renewable energy sources, while simultaneously creating DeFi instruments that help finance and monetize green energy infrastructure . Instead of treating sustainability as a cost or public relations exercise, Solenyrix makes it profitable through token rewards, reduced fees, and access to global capital markets.

This article explains what Solenyrix Token is, how it incentivizes green compute, how renewable energy projects can tokenize revenues, and why this model represents a critical step toward sustainable Web3 and AI infrastructure.

The Energy Problem in Web3 and AI Compute

Cryptocurrency mining and AI training workloads are notoriously energy-intensive. Proof-of-work blockchains like Bitcoin consume over 100 TWh annually, while large language model training runs can require megawatt-hours of electricity per session . Much of this power comes from coal, natural gas, or other non-renewable sources, contributing to carbon emissions and inviting regulatory scrutiny.

At the same time, renewable energy capacity is expanding rapidly—solar and wind installations are being built worldwide—but these projects face economic challenges:

- Intermittency: solar and wind output fluctuates with weather and time of day, making revenue unpredictable.

- Grid constraints: many renewable-rich regions lack sufficient transmission infrastructure to export excess power.

- Financing gaps: developers need upfront capital but struggle to secure favorable loans or offtake agreements due to perceived risk.

The irony is clear: compute operators need cheap, abundant energy, and renewable projects have excess capacity but lack stable demand and financing. A coordination mechanism is missing—one that aligns incentives, verifies claims, and channels capital efficiently .

The Origin Story of Solenyrix Token

Solenyrix Token was conceived by a team spanning renewable energy development, Web3 infrastructure operations, and DeFi protocol design . The founders had observed firsthand how crypto miners migrate to regions with cheap hydroelectric or geothermal power, and how solar farms sit underutilized because they cannot secure long-term purchase agreements.

The breakthrough insight was to create a protocol that:

- Rewards compute operators for using verified renewable energy with additional token incentives, making green power economically superior to fossil fuels.

- Tokenizes energy revenue streams from renewables projects, allowing them to raise capital from global DeFi markets rather than relying solely on traditional banks.

- Establishes transparent verification using IoT sensors, oracles, and energy certificates, ensuring claims are credible and auditable on-chain .

The name “Solenyrix” reflects this dual mission: solar and renewable energy (Sol-) combined with a focus on next-generation infrastructure (-enyrix), creating a bridge between physical energy assets and digital financial rails.

What Is Solenyrix Token?

Solenyrix Token is a utility and governance token powering a protocol that links renewable energy infrastructure with blockchain compute workloads and DeFi financial instruments .

The token serves multiple functions:

- Compute rewards

Validators, miners, AI clusters, and other compute operators earn Solenyrix bonuses when they prove they are powered by certified renewable sources. This creates financial incentives for adopting green energy beyond regulatory compliance or brand reputation. - Collateral and settlement in energy DeFi

Solenyrix is used as collateral, payment, and staking in financial products tied to renewable energy cash flows—such as tokenized power purchase agreements (PPAs) or energy revenue notes. - Fee payments

Verification services, tokenization platforms, and energy marketplace transactions charge fees denominated in Solenyrix, generating consistent demand. - Governance

Token holders vote on key parameters: which energy certifiers are trusted, which regions and technologies receive priority incentives, how rewards pools are allocated, and risk limits for energy-backed DeFi products .

Technically, Solenyrix is designed as an ERC-compatible token deployed on networks that support low-cost transactions and oracle integrations for real-world data verification.

Green Compute Rewards: Incentivizing Renewable-Powered Nodes

The core innovation of Solenyrix is its Green Compute Rewards program, which provides additional income to compute operators who can prove their energy comes from renewable sources .

How it works:

- Operators register their nodes, data centers, or mining facilities with the Solenyrix protocol, providing location, capacity, and energy source documentation.

- Verification happens through a combination of:

- Renewable Energy Certificates (RECs) or equivalent local standards.

- IoT sensors measuring real-time energy consumption and grid connection points.

- Oracles that relay this data on-chain in tamper-resistant form.

- Rewards distribution: operators receive Solenyrix tokens proportional to their verified renewable energy usage. For example, a validator running on 100% certified solar power earns a higher multiplier than one on mixed sources .

This creates a direct economic advantage: a miner or validator on green energy earns standard block rewards plus Solenyrix bonuses, effectively lowering their net energy cost. Over time, this shifts industry incentives toward renewable infrastructure without requiring top-down regulation.

Tokenized Energy Assets and DeFi for Renewables

Beyond rewarding compute operators, Solenyrix enables renewable energy projects to access global capital markets through tokenization .

Tokenized Power Purchase Agreements (PPAs)

A PPA is a long-term contract where a buyer agrees to purchase electricity from a generator at a fixed price. Traditionally, these contracts are illiquid and accessible only to large institutions. Solenyrix allows:

- On-chain representation: a solar farm’s 10-year PPA can be tokenized into tradable shares.

- Fractional ownership: investors worldwide can buy portions of the PPA’s cash flows, earning predictable returns as the farm generates and sells power.

- Liquidity: unlike traditional PPAs locked in legal agreements, tokenized versions can trade on secondary markets, providing exit options for investors.

Energy Revenue Notes

Projects can issue debt-like instruments backed by expected electricity sales:

- Investors purchase notes denominated in Solenyrix or stablecoins.

- As the renewable project generates revenue (selling power to the grid or directly to compute operators), it distributes payments to note holders.

- These notes offer stable, real-world yield uncorrelated with crypto market volatility .

By opening renewable energy financing to global DeFi participants, Solenyrix reduces dependency on local banks, lowers cost of capital, and accelerates deployment of green infrastructure.

Solenyrix Token Utility and Economic Model

Solenyrix’s tokenomics are designed to align incentives across compute operators, energy producers, investors, and the protocol itself .

Utility pillars:

- Compute rewards: continuous emission to green-verified nodes and validators.

- Staking and collateral: required for energy-backed DeFi products and governance participation.

- Transaction fees: verification services, PPA tokenization, and marketplace trades generate fee revenue.

- Governance: voting on certifier approvals, regional priorities, reward schedules, and risk parameters.

Economic principles:

- Controlled supply: limited or predictable issuance to avoid inflation eroding value.

- Balanced distribution: allocations to team (with vesting), energy project partners, compute reward pools, and ecosystem funds.

- Fee recycling: a portion of fees may be burned or locked, creating deflationary pressure as usage scales.

- Long-term alignment: those who build renewable capacity, operate green compute, or invest in energy DeFi earn proportionally, while extractive behavior is economically discouraged .

As more compute shifts to verified renewable sources and more energy projects tokenize revenues, natural demand for Solenyrix increases, driving value from real-world utility rather than speculation.

Energy Verification and Oracle Integration

Credibility depends on robust verification. Without it, Solenyrix risks becoming a greenwashing vehicle where operators falsely claim renewable status .

Verification mechanisms:

- Renewable Energy Certificates (RECs)

Operators purchase or generate RECs corresponding to their energy consumption, proving renewable sourcing through established certification bodies (e.g., I-REC, Green-e). - IoT sensor integration

Physical sensors at generation sites and consumption points measure real-time energy flows. Data is transmitted via secure APIs to oracle networks. - Oracle networks

Decentralized oracles aggregate sensor data, cross-reference with public grid data, and publish verified energy profiles on-chain. This creates an auditable trail anyone can inspect. - Geographic and temporal matching

The protocol tracks not just that energy is renewable, but when and where it was generated relative to compute usage, preventing “renewable washing” where credits are purchased from distant locations with no real impact .

This multi-layered approach ensures that Solenyrix rewards genuinely reflect green operations, building trust with users, investors, and regulators.

Use Cases: Nodes, Data Centers, and dApps

Solenyrix’s flexible architecture serves diverse participants across the compute and energy ecosystems .

Blockchain validators and miners

- Proof-of-Stake validators or mining operations transition to solar, wind, or hydro power.

- They earn standard network rewards plus Solenyrix bonuses, reducing effective energy costs and improving profitability.

- Regions with abundant renewable capacity (Iceland, Scandinavia, parts of Latin America) become more attractive for operations.

AI and high-performance compute

- GPU clusters training large language models or rendering CGI can certify renewable energy sources.

- Clients increasingly demand “green AI” for ESG compliance; operators on Solenyrix infrastructure can charge premium rates.

- Solenyrix bonuses offset higher upfront costs of renewable infrastructure.

DeFi protocols and dApps

- Protocols commit to running validators and infrastructure on Solenyrix-verified green nodes.

- They receive fee discounts, marketing support, and governance influence within the Solenyrix ecosystem.

- This creates competitive differentiation: being genuinely carbon-neutral or carbon-negative becomes a tangible advantage .

Financing Renewable Projects Through Solenyrix DeFi

Traditional renewable energy financing is slow, geographically limited, and often expensive. Solenyrix changes the model :

Example flow:

- A solar farm developer in Brazil wants to build a 50 MW installation but lacks local financing.

- They partner with Solenyrix to tokenize a 15-year PPA already signed with a regional utility.

- The PPA is divided into tradable units (ERC tokens) representing shares of future electricity revenue.

- Global investors purchase these tokens using Solenyrix or stablecoins, providing upfront capital to the developer.

- As the farm generates and sells power, revenue flows to token holders via smart contracts, with Solenyrix handling settlement and verification.

This model:

- Reduces reliance on local banks with restrictive lending criteria.

- Accesses deeper pools of global capital seeking stable, real-world yield.

- Provides transparency: investors see real-time generation data, revenue, and payment history on-chain.

- Lowers cost of capital, making renewable projects more competitive against fossil fuels .

Governance and Ecosystem Standards

Decentralized governance ensures Solenyrix evolves to meet real-world needs while maintaining credibility .

Key governance decisions:

- Certifier approval: which renewable energy certification bodies are recognized and trusted.

- Geographic priorities: which regions receive enhanced rewards to encourage renewable infrastructure development.

- Technology focus: relative incentives for solar vs. wind vs. hydro vs. geothermal, balancing grid stability and environmental impact.

- Reward pool allocation: how compute rewards are split across validators, miners, AI clusters, and other participants.

- Energy DeFi parameters: collateral ratios, acceptable PPA durations, and risk limits for tokenized energy products.

Token holders can delegate votes to specialized councils—renewable energy experts, DeFi economists, infrastructure operators—ensuring decisions are informed by domain knowledge rather than just token weight .

Risks and Limitations

While Solenyrix offers compelling benefits, significant risks remain :

- Verification integrity: sensors can malfunction, oracles can be manipulated, or operators may attempt to game certification systems.

- Regulatory complexity: energy markets are heavily regulated; tokenizing PPAs may require securities compliance in various jurisdictions.

- Geographic constraints: not all regions have access to abundant renewable resources, potentially creating unequal participation.

- Market adoption pace: convincing large-scale compute operators to transition infrastructure takes time and capital.

- Energy price volatility: renewable revenue streams are exposed to electricity price fluctuations, which can impact returns on energy-backed DeFi products.

Solenyrix mitigates these through:

- Multi-layered verification with redundant data sources.

- Proactive regulatory engagement and jurisdiction-specific compliance frameworks.

- Pilot programs in renewable-rich regions before global expansion.

- Transparent risk communication so investors understand exposure .

Roadmap and Long-Term Vision

Solenyrix’s development follows a phased approach balancing innovation with operational credibility :

Phase 1: Pilot and partnerships

- Launch verification infrastructure in 2-3 renewable-rich regions.

- Partner with initial compute operators (validators, small mining pools) to test reward mechanisms.

- Issue first tokenized PPA or energy revenue note to validate DeFi model.

Phase 2: Scaling compute rewards

- Expand to major blockchain networks and validator communities.

- Integrate with AI compute marketplaces and render farms.

- Increase geographic coverage and certifier partnerships.

Phase 3: Energy marketplace and DeFi platform

- Launch full marketplace for buying, selling, and trading tokenized energy assets.

- Enable secondary markets for PPAs and revenue notes.

- Attract institutional DeFi capital seeking stable, real-world yield.

Phase 4: Global green infrastructure standard

- Position Solenyrix as the default verification and incentive layer for sustainable Web3 compute.

- Influence industry standards: major blockchain networks adopt Solenyrix criteria for “green” status.

- Catalyze billions in capital flows toward renewable energy through DeFi channels .

The long-term vision is ambitious but grounded: make sustainability the economically rational choice for every compute operator, and unlock global capital to accelerate the renewable energy transition.

How to Participate in the Solenyrix Ecosystem

For compute operators (validators, miners, AI clusters):

- Assess your current energy sources and identify pathways to certified renewables.

- Register with Solenyrix protocol, providing location, capacity, and preliminary energy documentation.

- Install or integrate with IoT monitoring systems and begin verification process.

- Start earning Solenyrix rewards on top of standard compute income, reinvesting savings into further renewable capacity .

For renewable energy projects:

- Identify existing or planned projects with contractually committed revenue (PPAs, offtake agreements).

- Work with Solenyrix partners to structure tokenization: legal compliance, smart contract design, oracle integration.

- Issue tokenized energy assets to global investors, raising capital at competitive rates.

- Use proceeds to build, expand, or refinance renewable infrastructure.

For investors:

- Research available energy-backed DeFi products on Solenyrix platform: risk profiles, expected returns, underlying assets.

- Diversify portfolio with stable, real-world yield uncorrelated with traditional crypto volatility.

- Participate in governance to shape protocol priorities and risk management standards.

By aligning incentives across energy producers, compute consumers, and capital providers, Solenyrix Token creates a sustainable ecosystem where environmental responsibility and economic performance reinforce each other .