How Governments Are Using Crypto Laws to Shape Economic Futures

As governments around the globe adapt to the rise of cryptocurrency, legal changes in crypto are not just regulatory adjustments—they’re shaping the economic futures of nations. The implications for industries and consumers alike are profound and immediate.

Legal Changes in Crypto and Their Economic Impact

Recent legislative changes affecting cryptocurrency have emerged as crucial indicators of how nations view this digital asset. Countries like Russia have made headlines by legalizing crypto payments, signaling a potential shift towards more formal acceptance of digital currencies (FF News). Such legal transitions reflect a broader understanding that cryptocurrency can influence economic stability in both positive and negative ways.

For instance, regulatory clarity can lead to increased investment, as businesses feel more secure operating in an environment where laws govern their activities. Conversely, overly stringent regulations can stifle innovation and push businesses to less regulated jurisdictions. As governments enact laws to control cryptocurrencies, the aim often centers on economic stability—highlighting the delicate balance between fostering innovation and safeguarding consumer interests.

Countries like the United States and those across Europe are at the forefront of these shifts, enacting laws that elucidate tax implications for cryptocurrencies and set guidelines for transactions. This increased regulatory framework provides a clearer path for companies operating within these markets, arguably enhancing investor confidence.

Current Trends in Cryptocurrency Regulations

Significant trends in global cryptocurrency laws indicate a directional change towards greater oversight and regulation. Governments are increasingly recognizing the importance of establishing a legal framework that governs cryptocurrency transactions. For instance, regulators in the U.S. are currently holding discussions on the structure of crypto markets, striving to ensure safe trading environments (Punchbowl News).

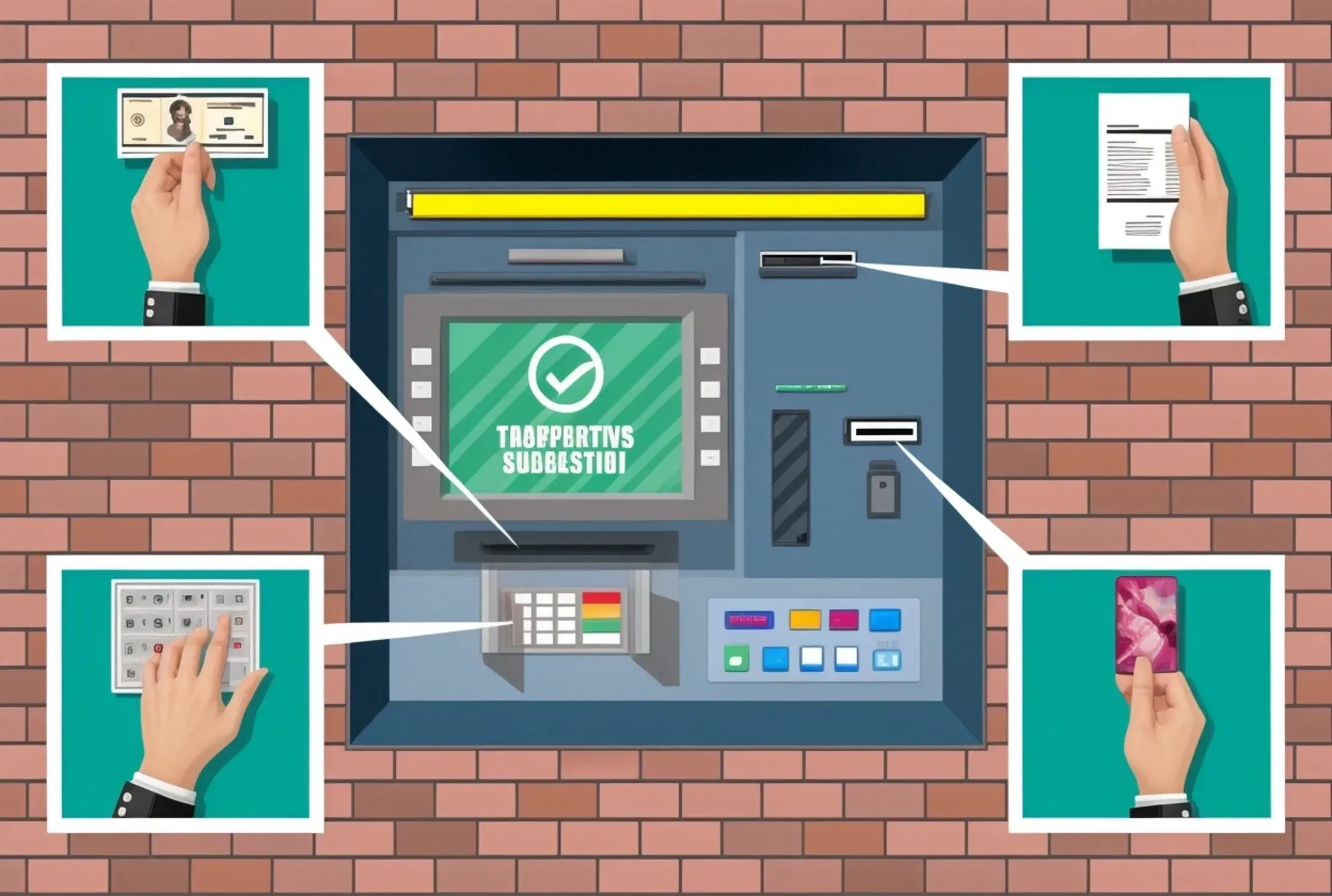

These emerging regulations aim to clarify the legal standing of digital assets, thereby influencing investor behavior and innovation in the crypto space. For example, the recent push for strict Know Your Customer (KYC) regulations across various jurisdictions aims to prevent fraud and enhance transparency. As a result, the effects of these regulations can be seen in consumer trust levels, which are essential for the broader adoption of cryptocurrencies.

Case Study: Bhutan’s Bitcoin Development Pledge

Bhutan’s ambitious commitment to invest 10,000 bitcoin in creating the Gelephu Mindfulness City serves as an intriguing case study in the economic implications of crypto laws. By classifying bitcoin as a strategic national asset, Bhutan aims to position itself as a leader in sustainable development centered around cryptocurrency mining powered by renewable energy (CoinDesk).

This initiative not only highlights the country’s unique approach to economic growth but also underscores the potential for bitcoin to be utilized effectively for local development. Bhutan’s strategic investment is calculated to assert its role in the future economic landscape, utilizing cryptocurrency to generate long-term stability and growth.

Bipartisan Efforts in Crypto Legislation

In the U.S., a notable trend is the growing bipartisan discussion around cryptocurrency legislation. Recently, lawmakers from both major political parties have come together to address the complexities of crypto regulations (Punchbowl News). This unity is crucial as it brings diverse perspectives to the table, enhancing the prospects of creating a balanced regulatory framework that can support innovation while ensuring investor protection.

Such discussions reflect the realization that the crypto market’s structure impacts the overall economic landscape. By fostering cooperation among legislators, financial institutions, and the tech community, there’s potential to craft laws that enhance market confidence, leading to a more robust investment environment. Investors often perceive bipartisan efforts as a positive signal, potentially elevating market stability.

The Future Economic Landscape Influenced by Crypto Laws

Predicting how evolving crypto regulations will transform economies presents challenges; however, several insights can be gleaned. As regulations mature, it is likely that investor behavior will shift, adapting to new standards and compliance requirements. Emerging markets might experience advantages in attracting crypto investment due to lenient regulations, raising concerns about economic inequality (FF News).

Moreover, disparities in regulatory frameworks across different regions may further widen the gap between developed and developing economies. If certain countries can attract more substantial investment through relaxed laws, it could lead to significant wealth concentrations in specific areas, thereby affecting overall global economic dynamics.

What Readers Can Do: Engage with Legislative Changes

To stay informed about the rapidly changing landscape of crypto laws, readers can take proactive measures. Engaging with local advocacy groups that focus on digital currency regulations is crucial for fostering voices that promote balanced legislation. Participating in discussions through forums or local meetings can enhance understanding and influence outcomes that align with community interests.

Additionally, educational resources and platforms offer insights into regulatory developments. By staying educated and involved, individuals can contribute to shaping the future of cryptocurrency regulations that not only support innovation but also protect consumers in an evolving financial ecosystem.