How Nexalume Token Turns Fragmented Data Silos into an On‑Chain AI Data Economy

Traditional data markets are opaque, slow, and built for incumbents. Large corporations and specialized brokers sit between data producers and data consumers, charging high margins for access to information that is often poorly documented, inconsistently licensed, and difficult to integrate at scale . At the same time, AI teams, quant funds, and analytics engineers desperately need fresh, high‑quality data to power models and insights. Public datasets are not enough, but private data feeds are expensive, fragmented, and locked behind contracts that do not translate well into the programmable world of Web3.

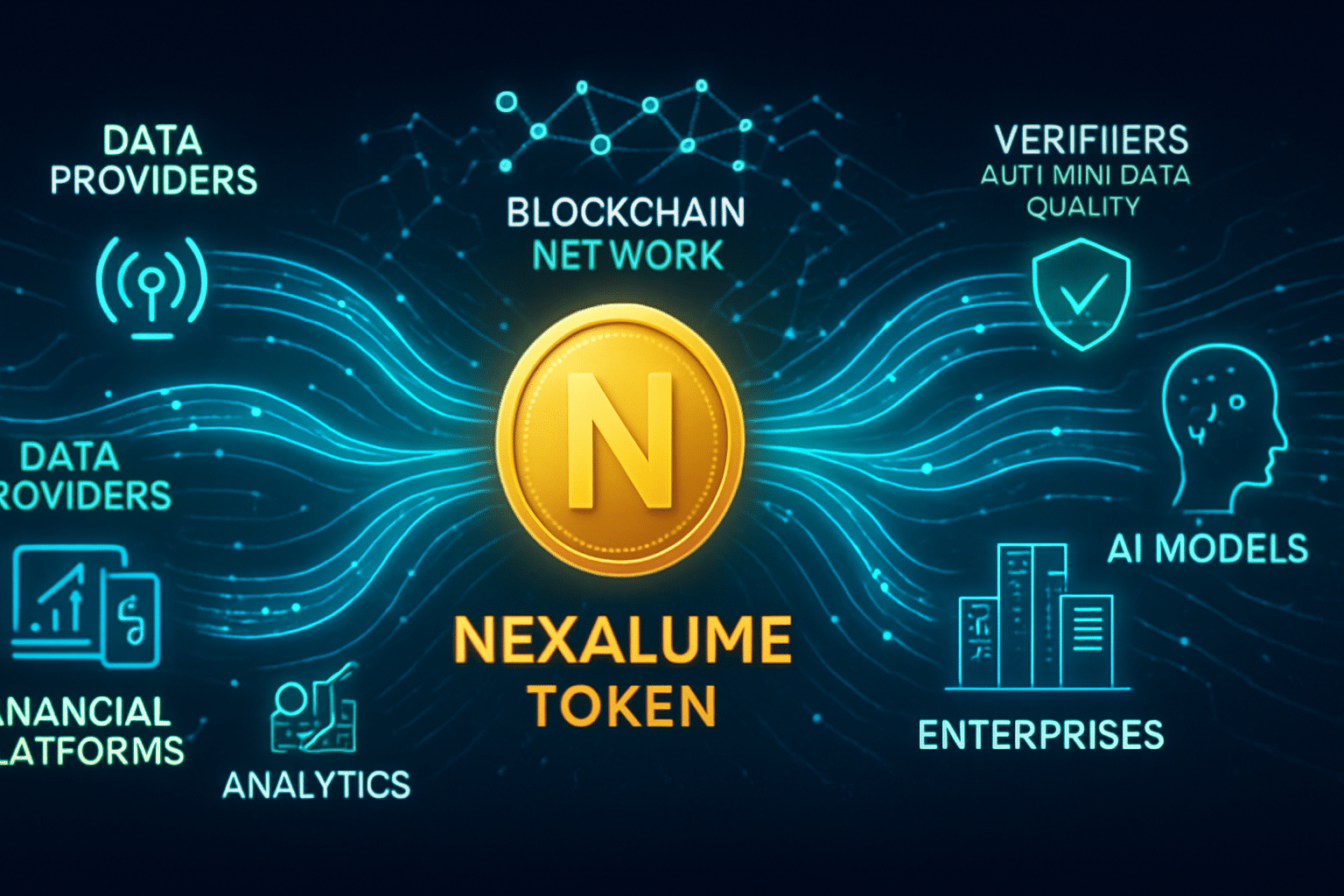

Nexalume Token proposes a different approach: a decentralized, on‑chain data marketplace where streams and datasets can be discovered, priced, purchased, and verified using a shared token and transparent smart contracts . Instead of each provider building their own billing and access logic, Nexalume standardizes how data is monetized and how quality is enforced. This article explains what Nexalume Token is, how the protocol works, why the token has real utility, and how different participants—providers, consumers, and verifiers—can benefit from this new data economy.

The Problem with Today’s Data Markets

The current data landscape is defined by silos and intermediaries. Valuable information—from financial tick data and IoT telemetry to marketing signals and behavioral analytics—is controlled by a small number of platforms and brokers . Pricing is negotiated privately, contract terms vary wildly, and small or mid‑size companies face significant friction just to experiment with new data sources.

Key issues include:

- Opacity in pricing and licensing: buyers often do not know whether they are overpaying or what they are actually allowed to do with the data.

- Fragmented access: integrating multiple providers requires separate APIs, contracts, billing systems, and operational overhead.

- Limited inclusion: smaller data producers (startups, niche SaaS tools, specialized sensors) struggle to monetize their assets because they lack distribution channels.

This model does not fit the emerging AI‑driven world, where models thrive on diverse, composable datasets and where programmable access is more valuable than static CSV files. Nexalume aims to replace brokered, closed data deals with a transparent, programmable protocol that treats data as a first‑class on‑chain asset .

What Is Nexalume Token?

Nexalume Token is the native utility asset of a decentralized protocol for trading data streams and datasets. It acts as the economic and governance layer of an open marketplace where anyone can list, discover, and consume data products .

The token has four primary functions:

- Settlement currency

All financial flows in the marketplace—subscription fees, per‑request charges, snapshot purchases—are denominated in Nexalume. This creates a unified settlement layer and removes the need for each provider to build custom billing rails. - Staking collateral

Data providers stake Nexalume to signal their commitment to quality and long‑term service. Higher stake, combined with strong delivery history, increases catalogue ranking and overall trust. - Dispute and verification fuel

Nexalume is locked in escrow when disputes arise and used to reward verifiers who help resolve conflicts about data quality or delivery. - Governance token

Holders participate in on‑chain governance, deciding on standards, risk parameters, and allocation of ecosystem funds for growth and tooling.

Technically, Nexalume is envisioned as an ERC‑compatible token deployed on a chain or Layer 2 that supports low‑cost, high‑throughput transactions. This is critical because data access often consists of many small, frequent operations rather than a few large transfers .

How the Nexalume Data Marketplace Works

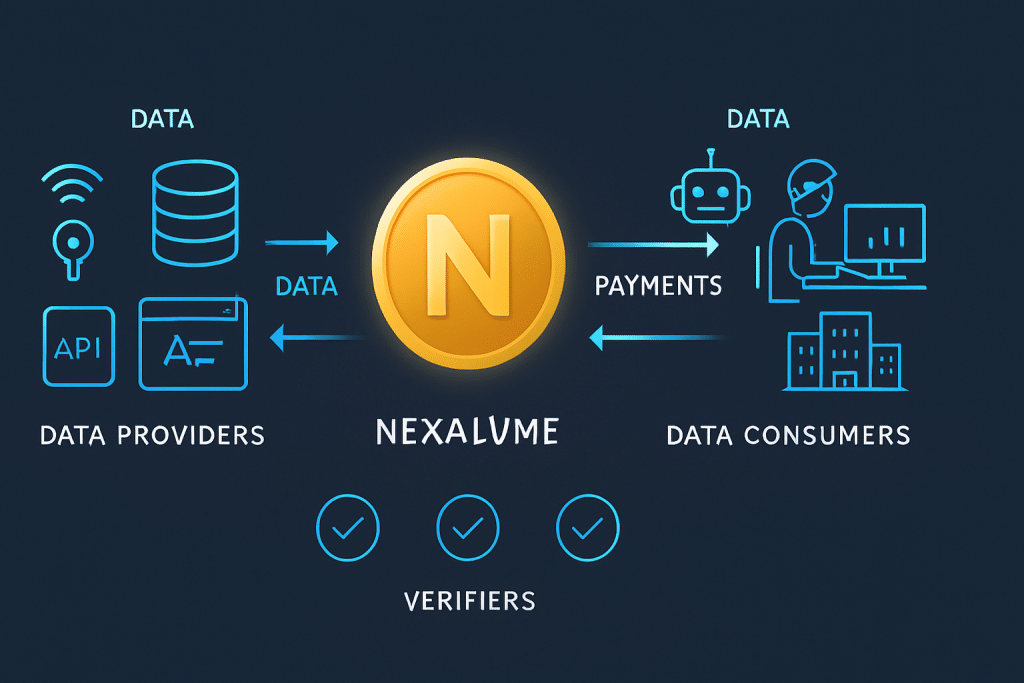

The Nexalume protocol organizes the marketplace around three core roles: data providers, data consumers, and verifiers. The protocol handles registration, payments, staking, and dispute resolution, while data itself typically flows off‑chain through secure endpoints .

Data providers

Providers can be:

- SaaS platforms with aggregated analytics

- IoT networks streaming sensor data

- Market data vendors

- Specialized research firms or independent analysts

They:

- Register data products on‑chain, including metadata such as domain, schema, granularity, update frequency, and licensing terms.

- Choose pricing models (per‑request, per‑time, per‑record, subscription).

- Stake Nexalume Tokens to unlock higher visibility and demonstrate skin in the game.

Data consumers

Consumers include:

- AI and ML teams training models

- Quant funds and algorithmic traders

- Analytics teams and BI platforms

- Builders of downstream data products

They:

- Browse an on‑chain registry of data products, filter by category, quality rating, and price.

- Pay for access in Nexalume, either as one‑off purchases or ongoing subscriptions.

- Integrate provider endpoints into their pipelines using SDKs and standardized schemas.

Verifiers and auditors

Independent verifiers:

- Sample portions of data feeds and check for consistency, timeliness, and adherence to advertised properties.

- Participate in dispute resolution by voting on the validity of user complaints.

- Earn Nexalume rewards in exchange for honest, high‑quality verification work.

The protocol does not force a single storage strategy. Providers may use object storage, streaming gateways, or traditional APIs, while Nexalume smart contracts keep track of who has paid, who is entitled to access, and how value should be distributed .

Flexible Pricing Models: Streams, Snapshots, Subscriptions

Different data products require different economic models. Nexalume is built to support three core pricing types, which providers can mix and match :

- Streaming data: Ideal for real‑time or low‑latency feeds such as:

- Market microstructure dataSensor/IoT telemetrySocial media sentiment streamsOn‑chain transaction events

- Static snapshots: Suitable for:

- Historical tick dataArchived logsPeriodic reports and benchmark datasets

- Single upfront payment in Nexalume for a defined snapshot or archive

- Optional renewal or update fees

- Subscriptions: Useful when:

- Consumers need long‑term, predictable accessProviders want recurring revenue streams

- Monthly access to a basket of macroeconomic indicators

- Annual subscription to updated fraud detection datasets

- Tiered enterprise plans with SLAs

Smart contracts encoded in the protocol automatically split incoming Nexalume payments among providers, verifiers, indexers, and the protocol treasury, according to pre‑defined rules. This eliminates opaque take‑rates and allows all participants to see exactly where value flows .

Staking and Reputation: Building Trust in Data Providers

In any marketplace, quality and trust are crucial. Nexalume leverages staking‑based reputation to align incentives between providers and consumers .

Key elements:

- Provider stake:

Providers deposit Nexalume Tokens into staking contracts associated with their data products or identity. This stake acts as a visible signal of confidence in their own services. - Reputation and ranking:

On‑chain data about uptime, dispute history, user ratings, and stake size is combined into a reputation score. Marketplace interfaces can then rank products accordingly, so high‑reputation feeds appear more prominently. - Economic consequences:

When disputes are decided against a provider—due to false advertising, chronic outages, or manipulated data—a portion of their stake can be slashed and redistributed to affected consumers and honest verifiers. Conversely, consistent high performance and low dispute rates may unlock better revenue shares or incentives.

This mechanism encourages providers to think long term: it becomes irrational to sacrifice data quality for short‑term gains when real capital is at risk .

Dispute Resolution and Verification

Even with strong incentives, disagreements will occur. Nexalume addresses this through an on‑chain dispute resolution workflow backed by economic guarantees .

Typical process:

- Dispute initiation

A consumer who believes that a data product failed to meet its stated guarantees (e.g., freshness, completeness, accuracy) initiates a dispute by locking a portion of the transaction amount in escrow. - Evidence submission

Both sides can submit evidence, such as sample records, logs, or timing metrics. This evidence may be anchored or referenced on‑chain. - Verifier review

A set of verifiers—entities that have staked Nexalume and built a record as data auditors—review the evidence and vote on the outcome. Voting power may be proportional to stake or reputation. - Outcome and settlement

- If the provider is found at fault, the consumer may receive a refund, and some fraction of the provider’s stake can be slashed.

- If the dispute is deemed malicious or frivolous, the consumer’s locked amount can be penalized instead.

- Verifiers earn a share of the resolved funds as compensation for their work.

Because participation in disputes is tied to real tokens, all parties are incentivized to act honestly and reserve disputes for serious, evidence‑backed issues .

AI and Analytics Use Cases

The Nexalume model is particularly powerful in domains where data is both crucial and expensive to source .

AI model training

- ML teams can assemble training datasets by combining multiple niche feeds rather than relying solely on generic public data.

- It becomes easier to experiment: acquire a small sample of a feed, evaluate its predictive power, and scale up only if it proves valuable.

- Payment and access are standardized across providers, simplifying MLOps pipelines.

Quantitative trading and signal research

- Quant desks and independent traders can subscribe to a wide range of alternative data: on‑chain flows, sentiment indices, macro indicators, and event‑driven data.

- By having all providers on a common settlement and discovery layer, strategy researchers can quickly rotate between data sources, favoring those that improve performance.

Embedded marketplaces in SaaS

- Analytics, CRM, or BI products can embed Nexalume’s marketplace so their customers can add new data sources without leaving the platform.

- This creates a new revenue stream for SaaS vendors (via revenue share) and a wider audience for data providers, while customers benefit from one consistent integration pattern.

Token Utility and Economic Design

Nexalume’s token model is engineered around real protocol activity rather than pure speculation .

Utility pillars:

- Transaction medium: all marketplace purchases and subscriptions use Nexalume.

- Staking tool: providers, verifiers, and potentially indexers stake the token to secure roles and earn rewards.

- Governance right: token holders influence standards, fee ratios, treasury grants, and vertical priorities.

- Security buffer: in some designs, part of the treasury or fees can form an insurance or risk buffer for extreme events.

Design principles:

- Controlled supply: either fixed or with a predictable, modest inflation schedule to fund security and growth without eroding value.

- Fair initial distribution: allocations to team, early partners, ecosystem funds, and community members should be vested and transparent.

- Fee recycling: a fraction of protocol fees may be burned or locked long term, aligning token scarcity with actual marketplace usage.

- Aligned incentives: those who contribute most—via high‑quality data, verification, or tooling—have the clearest path to earning and influencing.

In this way, Nexalume becomes valuable not because people speculate on it, but because they need it to participate meaningfully in the data economy the protocol powers .

Governance and Ecosystem Stewardship

Decentralized governance ensures that no single company permanently controls the Nexalume protocol. Instead, token holders collectively steer its evolution .

Governance scope includes:

- Data standards and schemas: defining minimal metadata, quality constraints, and interoperability rules for listed products.

- Vertical focus: prioritizing which sectors receive technical and grant support (e.g., financial data first, then climate, then IoT).

- Economic parameters: setting staking requirements, slashing ratios, and reward schedules.

- Treasury management: funding developer tooling, integrations, verification services, and marketing.

To avoid shallow voting, stakeholders can delegate their voting power to domain experts—such as leading data scientists, infrastructure providers, or community‑elected councils—who specialize in particular decisions. Good governance helps maintain the credibility of Nexalume as a neutral infrastructure layer rather than a biased marketplace .

Risks and Limitations

Like any ambitious protocol, Nexalume faces serious challenges that should not be overlooked :

- Regulation and compliance

Certain data types—especially personal, financial, or health‑related—are heavily regulated. The protocol must incorporate privacy‑preserving techniques, compliance filters, and regional restrictions. - Bootstrapping high‑quality supply

Early on, the marketplace may struggle to attract reputable providers and verifiers. The design must include strong incentives and easy tooling to onboard serious players. - Pricing discovery

For many niche datasets, there is no established “market price”. Expect an experimental phase with under‑ and over‑pricing before markets mature. - Competition from incumbents

Large cloud providers and existing brokers may respond with bundled offerings or lower prices. Nexalume’s advantage must come from transparency, composability, and long‑tail participation.

These risks do not invalidate the model but highlight the need for careful rollout: focusing first on domains where regulatory risk is lower and where decentralized infrastructure offers a clear, immediate advantage .

Roadmap and Future Vision

A sensible roadmap for Nexalume balances technical maturity, ecosystem building, and governance decentralization .

Phase 1 – Core protocol and pilots

- Deploy registry, payment, and staking contracts.

- Launch with a small set of vetted providers in one or two verticals.

- Release basic SDKs and documentation for both providers and consumers.

Phase 2 – Marketplace expansion

- Onboard more providers, including niche alternative data sources.

- Launch the verifier network and initial dispute resolution tools.

- Integrate with AI/ML frameworks and data platforms for “click‑to‑train” experiences.

Phase 3 – Institutional integration

- Partner with SaaS and enterprise data platforms to embed Nexalume as a marketplace module.

- Develop compliance layers and access controls for sensitive data categories.

- Gradually decentralize governance over standards and treasury.

Phase 4 – Data finance infrastructure

- Enable structured financial products based on data revenue streams (e.g., data‑backed notes).

- Position Nexalume as the default settlement and reputation layer for multiple independent data marketplaces and aggregators.

- Foster a global ecosystem where data is traded with the same transparency and composability that DeFi brought to capital.

In the long run, Nexalume aims to be to data what major DeFi protocols are to liquidity: a foundational layer enabling transparent, programmable markets that unlock new business models and innovation .

How to Participate in the Nexalume Ecosystem

For data providers

- Identify non‑sensitive, high‑value datasets or streams you can legally share or monetize.

- Integrate with Nexalume’s provider tools to register products, define pricing, and connect endpoints.

- Stake Nexalume to build reputation and qualify for better visibility and revenue share.

For data consumers

- Set up a compatible wallet and acquire Nexalume Tokens.

- Explore the catalog for relevant datasets and trial access to evaluate quality.

- Integrate chosen feeds into your training, trading, or analytics pipelines using standardized SDKs.

For verifiers and developers

- Run verification jobs on sample data and participate in dispute resolution.

- Build explorers, dashboards, and analysis tools that help users understand provider performance and data reliability.

- Contribute to governance proposals that improve standards, security, and ecosystem growth.

By aligning economic incentives around honesty, quality, and openness, Nexalume Token offers a path toward a fairer, more efficient data economy—one where powerful AI and analytics are built on transparent, composable information flows rather than opaque, brokered deals .