Why Crypto ATMs Are Revolutionizing Access to Digital Currency

As digital currency becomes more mainstream, crypto ATMs are emerging as pivotal gateways for users. They provide immediate access to cryptocurrencies, but increased scams emphasize the need for enhanced consumer trust and security measures. Addressing these challenges is crucial as the market evolves.

Why Consumer Trust is Crucial in Crypto ATMs

Consumer trust is paramount in the operation of crypto ATMs. The rise of scams related to these platforms has heightened concerns among potential users. According to recent reports, many individuals have fallen victim to fraudulent schemes which promise high returns but deliver nothing. Protecting users through the implementation of safeguards is essential to restore confidence in this financial technology.

Operators need to ensure transparency and compliance. Implementing clear policies about fees, exchange rates, and security features can help users feel more comfortable making transactions. Moreover, cooperation with regulatory bodies can set up credible standards that all operators must adhere to. This commitment to integrity not only benefits current users, but it also attracts new customers seeking secure ways to engage with digital currency.

The Role of Financial Technology in Crypto Access

Financial technology plays a critical role in making cryptocurrencies accessible to a broader audience. Today’s innovations are simplifying processes around crypto transactions. Companies like Banxa are integrating with other platforms like Mezo to offer seamless transitions between fiat and digital currencies.

Through technological advancements, users can purchase cryptocurrencies without extensive knowledge or technical skills. This ease of access promotes growth in the crypto market, making it more inviting to new participants. As Matt Luongo, Founder and CEO of Thesis and Co-Founder of Mezo, articulated, “Bitcoin opened the door, but there’s still a gap between holding it and actually being able to use it day-to-day.”

Today’s innovations bridge that gap, ensuring that digital currency can coexist comfortably alongside traditional financial systems. This is an exceptional development, as it creates a pathway for broader adoption of cryptocurrencies in everyday scenarios.

Current Landscape of Crypto ATMs Worldwide

The rapid growth of crypto ATMs is a testament to the evolving landscape of digital currency. With close to 40,000 crypto ATMs operating worldwide, various regions are experiencing a surge in their presence. The concentration of these machines in urban areas suggests a growing demand for immediate, user-friendly ways to buy and sell cryptocurrencies.

User demographics indicate varied motivations for utilizing crypto ATMs. Many users are younger, tech-savvy individuals looking to invest or experiment with digital currency. Conversely, others may be older adults interested in diversifying their financial assets. As the market evolves, understanding these demographics will help operators tailor their services to meet distinct user needs.

Challenges Facing Crypto ATM Operators

Despite the potential, crypto ATM operators face significant challenges. Regulatory compliance remains a critical hurdle, as the landscape is continually changing. Operators must stay informed on local laws and international regulations to avoid potential legal ramifications.

Additionally, the need for user education cannot be overstated. Operators should prioritize providing clear information about how to use ATMs safely and securely. This includes tips on identifying potential scams and understanding transaction fees. By educating users, operators can mitigate risks associated with crypto scams and build a strong foundation of trust within the community.

Increasing Access to Digital Currency Through Education

Public education plays an essential role in fostering a knowledgeable user base. By enhancing consumer understanding of cryptocurrencies, the likelihood of scams decreases. Initiatives aimed at promoting financial literacy within communities can empower individuals to make informed decisions.

Collaborations between educational institutions and industry leaders can create programs that cater to the needs of various demographics. Such initiatives can promote clear pathways to understanding digital currency and its potential benefits while simultaneously highlighting the risks involved.

Furthermore, educational campaigns can guide users to reputable sources and platforms, enhancing overall trust in the crypto ecosystem. For operators, engaging in these educational efforts can bolster their reputation and position them as credible entities in the financial technology landscape.

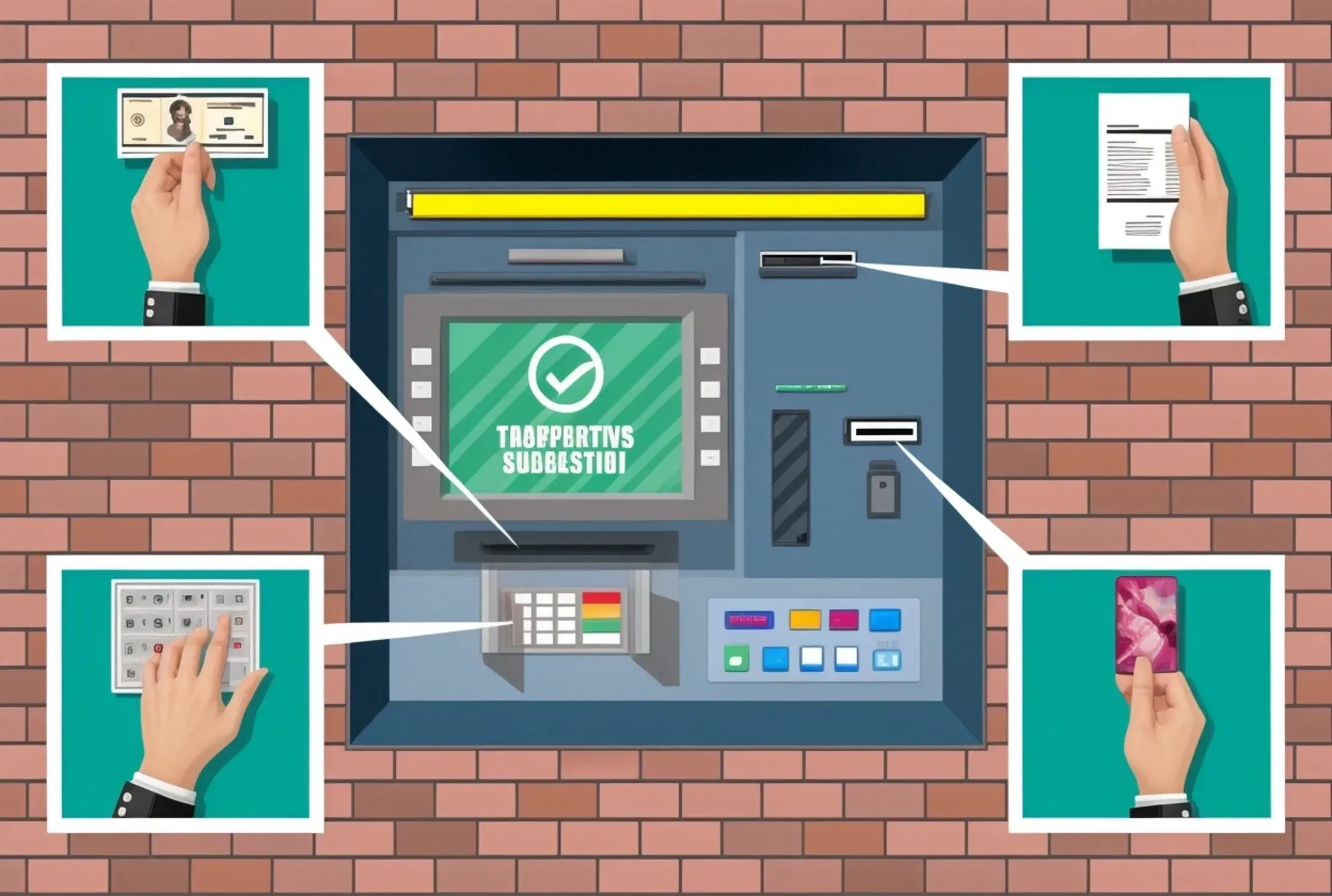

Actionable Steps to Engage with Crypto ATMs

Using crypto ATMs effectively requires an understanding of best practices. Here are some tips to ensure safe and efficient transactions:

1. Research Before Using: Familiarize yourself with how crypto ATMs operate and the fees involved.

2. Verify Reporting: Check the legitimacy of the ATM operator and obtain information from trusted sources.

3. Stay Informed: Educate yourself about common scams to spot red flags during transactions.

4. Maintain Security: Use secure wallets and keep your private keys confidential.

For operators, promoting transparency is crucial. Regularly updating the public on security measures and compliance can enhance consumer confidence. Furthermore, actively participating in community education initiatives can distinguish operators as trustworthy entities in the market.

By following these actionable steps, both users and operators can contribute to a more secure and accessible crypto ATM environment, fostering growth in the digital currency ecosystem.