How Deryxion Token Brings Transparent, On-Chain Structured Yield to DeFi

Decentralized finance has unlocked liquidity, composability and permissionless access to financial primitives, but it has largely failed to deliver sustainable, real-world yield. Most DeFi returns are driven by token emissions, liquidity mining incentives, or circular leverage—mechanisms that work until they don’t, often leaving users with inflated APYs that evaporate overnight . Meanwhile, traditional finance offers structured products, bonds, and yield-generating notes backed by real cash flows, but these remain locked behind private banking walls, opaque pricing, and institutional-only access.

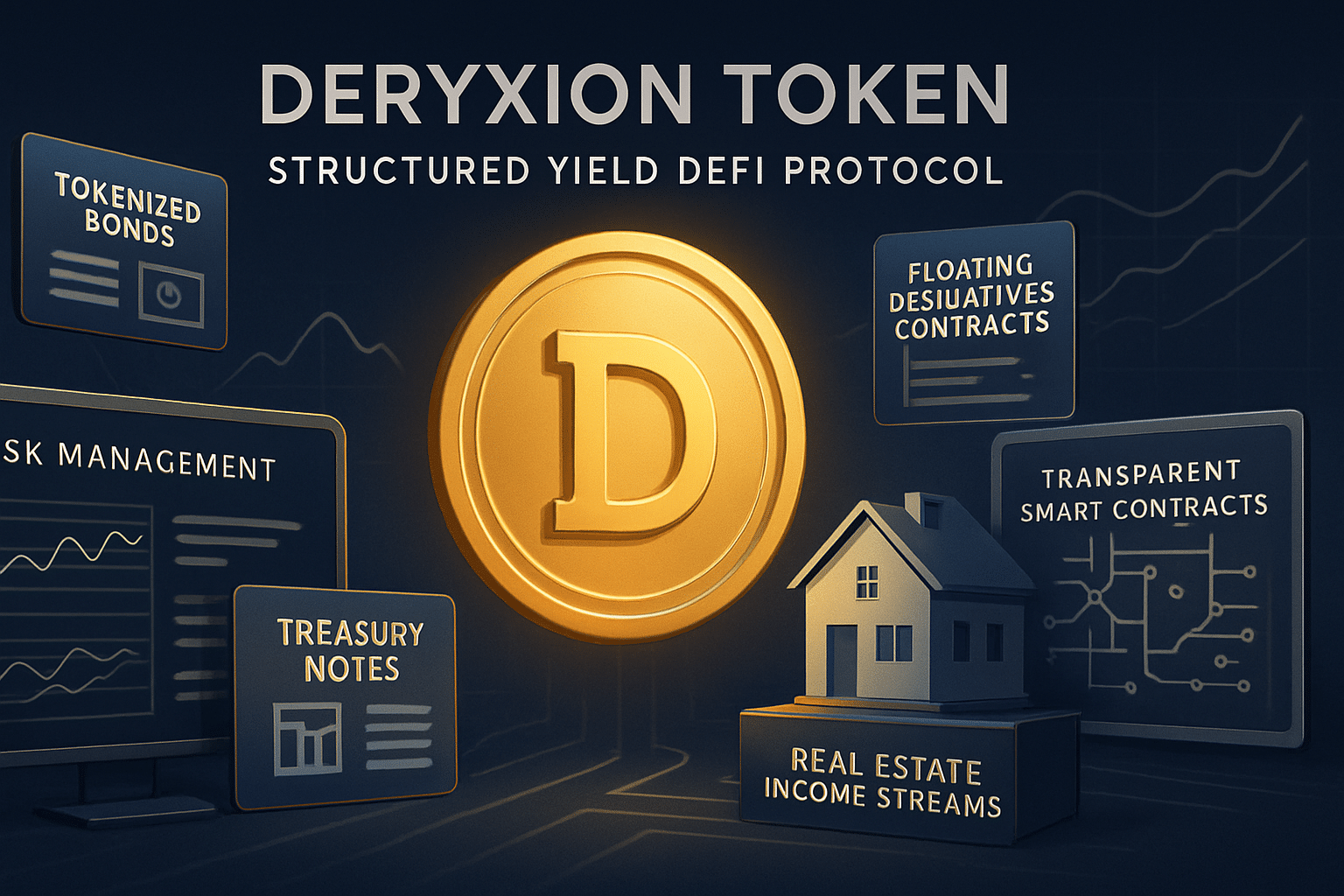

Deryxion Token proposes a bridge between these two worlds: a DeFi protocol for on-chain derivatives and structured products that are transparently engineered, backed by verifiable real-world income streams, and accessible to anyone with a wallet . Instead of chasing unsustainable farm rewards, Deryxion enables users to invest in programmable yield structures tied to tokenized treasuries, invoice financing, real estate income, and other cash-generating assets. This article explains what Deryxion Token is, how the protocol creates and manages structured products, why the token has concrete utility, and how different participants can benefit from transparent, risk-managed DeFi yield.

Why Traditional Structured Products Are Broken

Structured products in traditional finance—such as principal-protected notes, autocallables, or yield enhancement instruments—combine fixed income with derivatives to offer tailored risk-return profiles . Banks and wealth managers use them extensively, but several fundamental problems persist:

- Opacity: investors rarely see the internal workings, fees, or real cost of embedded options.

- High barriers: minimum investments often start at tens or hundreds of thousands of dollars, excluding retail participants.

- Complexity without transparency: terms are buried in hundred-page prospectuses written in legal jargon, making independent risk assessment nearly impossible.

- Intermediary capture: banks charge hefty fees and earn on both structuring and distribution, with limited accountability if products underperform.

For the Web3 generation accustomed to reading smart contract code, querying on-chain data, and verifying protocol mechanics independently, this closed model is unacceptable. Yet pure DeFi has not delivered a credible alternative: most “yield” protocols either recycle liquidity or rely on unsustainable emissions . What is missing is infrastructure that combines DeFi’s transparency and composability with TradFi’s access to real economic cash flows.

The Origin Story of Deryxion Token

Deryxion Token was conceived by a team spanning traditional derivatives trading, quantitative risk management, and smart contract engineering . The founders had worked in both institutional finance—where they structured complex products for hedge funds and family offices—and DeFi protocols, where they saw retail users chasing yields without understanding underlying risks.

The key insight was simple but powerful: rather than building yet another yield farm or lending market, why not create a protocol where structured products and derivatives are issued on-chain with full transparency? Users could see exactly what assets back a product, what the payout formula is, and how risk is managed—all encoded in auditable smart contracts . The name “Deryxion” reflects this mission: a direction engine for yield, steering capital toward real, verifiable income rather than speculative token inflation.

What Is Deryxion Token?

Deryxion Token is the native utility and governance asset of a protocol that enables the creation, trading, and management of on-chain structured products and derivatives backed by real-world yield sources .

The token serves four core functions:

- Fee payment

Creating, managing, and redeeming structured products requires payment in Deryxion. This includes fees for strategy deployment, periodic rebalancing, and early exit charges. - Staking by strategy creators and risk managers

Individuals or teams who design yield strategies must stake Deryxion to signal commitment and skin in the game. Their stake can be slashed if strategies fail to meet stated risk parameters or if they engage in malicious behavior . - Governance

Token holders vote on critical protocol parameters: which asset types can be used as collateral, maximum leverage ratios, oracle provider selection, and treasury fund allocation. - Backstop reserve

A portion of Deryxion tokens or protocol fees can form an insurance buffer to protect users in extreme market events, aligning long-term token holders with protocol solvency .

Technically, Deryxion is designed as an ERC-compatible token on a network that supports complex DeFi operations with reasonable gas costs, often leveraging Layer 2 solutions for scalability.

Real-World Yield: What Backs Deryxion Products

Unlike reflexive DeFi yield that depends on new users or token inflation, Deryxion structured products aim to be backed by real income-generating assets :

- Tokenized government bonds: U.S. Treasuries, sovereign bonds, and other fixed-income instruments brought on-chain via protocols like Franklin Templeton’s BENJI or similar RWA platforms.

- Invoice and trade financing: tokenized invoices or receivables from real businesses, generating cash flows as buyers settle payments.

- Real estate income streams: tokenized rental income or property-backed revenue notes.

- DeFi protocol revenues: fees from established DeFi protocols (e.g., DEX trading fees, lending spreads) can be structured into yield products.

By anchoring products to these sources, Deryxion aims to offer yield that persists even during crypto bear markets, providing stability and diversification for DeFi portfolios . Integration happens through partnerships with RWA tokenization platforms, custodians, and oracles that verify off-chain cash flows.

How On-Chain Structured Products Work

A typical Deryxion structured product is a smart contract that encodes specific payout rules, maturity dates, risk limits, and underlying asset allocations . Users deposit capital (often in stablecoins or blue-chip crypto), and the protocol deploys it according to the strategy’s logic.

Example structures:

- Principal-protected note with crypto upside

- 80% of capital allocated to tokenized U.S. Treasuries yielding ~5% annually.

- 20% used to purchase call options on a crypto index.

- At maturity, users receive their principal plus any gains from the option, capped or uncapped depending on design.

- Autocallable yield note

- Capital deployed into a mix of stablecoins and RWA yield.

- Periodic observations: if certain conditions are met (e.g., stablecoin peg holds, no defaults), users receive a fixed coupon and early exit option.

- If conditions fail, capital remains locked until maturity or trigger events.

- Market-neutral derivative strategy

- Combines long and short positions in correlated assets, harvesting basis or funding rate differentials.

- Yield comes from arbitrage or spread capture rather than directional bets.

Each product is represented by tokenized shares (often ERC-4626 vaults or similar standards), making positions transferable and composable with other DeFi protocols .

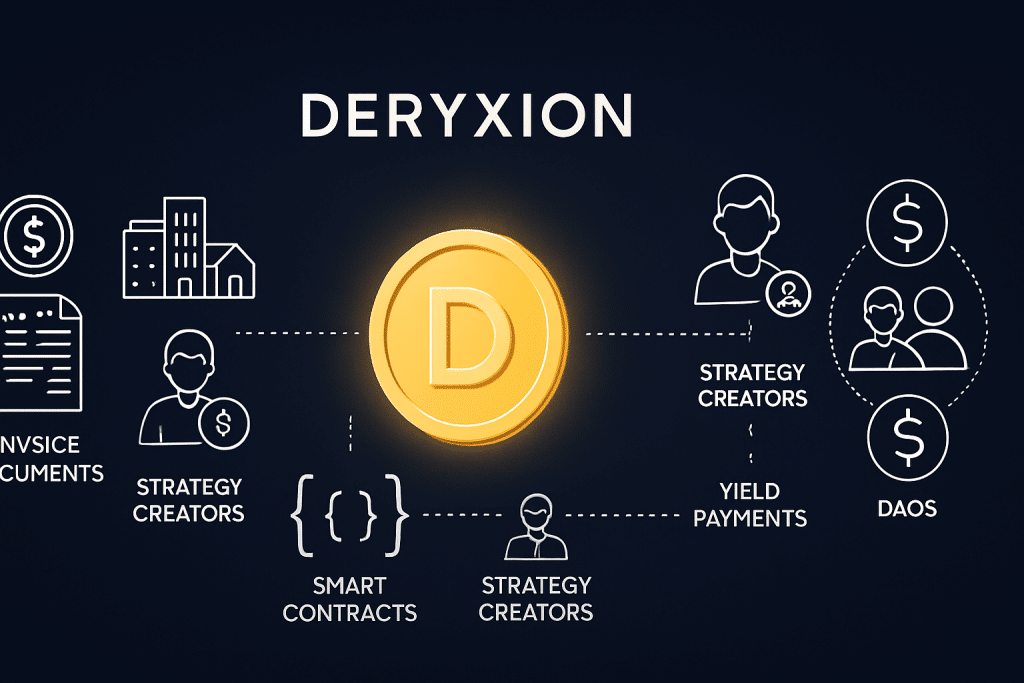

Role of Strategy Creators and Risk Managers

Deryxion introduces a new participant type: strategy creators or risk managers—individuals or teams who design and propose structured products .

Their responsibilities include:

- Defining asset allocation, payout formulas, risk limits, and maturity terms.

- Specifying oracle feeds and rebalancing rules.

- Documenting expected returns, worst-case scenarios, and stress test results.

- Staking Deryxion Token as a bond against their strategy’s performance.

When users allocate capital to a strategy, a portion of protocol fees flows to the strategy creator as compensation. However, if a strategy systematically underperforms its stated parameters—due to poor design, hidden risks, or negligence—governance can vote to slash the creator’s stake and redistribute it to affected users .

This mechanism creates strong incentives for honest, well-researched product design. Creators with strong track records build on-chain reputation, attract more capital, and earn higher fee shares, while bad actors are economically penalized and excluded.

Deryxion Token Utility and Economic Model

Deryxion’s tokenomics are designed around real protocol activity and long-term sustainability :

Utility pillars:

- Transaction fees: all product creation, management, and redemption operations require Deryxion payments.

- Staking: strategy creators, risk managers, and potentially large liquidity providers stake tokens to participate and earn rewards.

- Governance: token holders decide on collateral whitelists, leverage caps, oracle selections, and treasury spending.

- Insurance pool: a portion of fees or tokens can be reserved as a backstop fund for extreme events, aligning holder interests with protocol safety.

Economic principles:

- Controlled supply: fixed or low-inflation model to prevent value dilution.

- Fair distribution: allocations to team (with multi-year vesting), early supporters, ecosystem funds, and community incentives.

- Fee recycling: a fraction of protocol fees may be burned or locked long-term, creating deflationary pressure as usage grows.

- Aligned incentives: those who contribute high-quality strategies, risk management, or liquidity earn proportionally more, while poor performers lose stake.

This structure ensures that Deryxion’s value is tied to real demand for structured products and derivatives, not speculative hype .

Risk Management and Transparency

One of Deryxion’s core value propositions is transparent risk management—a stark contrast to opaque TradFi structures .

Key transparency features:

- Open smart contracts: all payout logic, asset allocations, and trigger conditions are visible on-chain and auditable.

- Real-time dashboards: users can track collateralization ratios, underlying asset performance, historical returns, and risk metrics (VaR, max drawdown, Sharpe ratio).

- Oracle verification: off-chain data (e.g., Treasury yields, invoice settlement) is fed via multiple oracle providers, with consensus mechanisms to prevent manipulation.

Risk controls:

- Collateral limits: governance sets maximum exposure to any single asset type or counterparty.

- Stress testing: strategies must pass simulated stress scenarios (e.g., 30% market drop, stablecoin depeg) before launch.

- Circuit breakers: if certain thresholds are breached (e.g., collateral drops below safety margin), automated actions trigger: position unwinding, additional collateral calls, or product suspension.

These mechanisms do not eliminate risk but make it measurable, understandable, and manageable—empowering users to make informed decisions rather than blindly trusting intermediaries .

Use Cases for Different Types of Investors

Deryxion’s flexibility allows it to serve diverse user segments with tailored products .

Conservative DeFi users

- Goal: preserve capital while earning modest, stable yield.

- Products: principal-protected notes backed by tokenized Treasuries, with minimal or zero exposure to volatile crypto assets.

- Expected returns: 4-8% annually, depending on Treasury rates and product structure.

Yield seekers and DeFi natives

- Goal: enhance returns through structured exposure to crypto markets while limiting downside.

- Products: autocallable notes with embedded call options on BTC/ETH, volatility-harvesting strategies, or basis trading structures.

- Expected returns: 10-20%+ in favorable conditions, with defined risk caps.

DAOs and protocol treasuries

- Goal: deploy idle treasury funds productively without excessive risk.

- Products: custom structured notes tailored to DAO needs—e.g., capital preservation with upside in ecosystem tokens, or diversified RWA baskets.

- Benefits: transparent on-chain execution, governance oversight, and alignment with community risk appetite .

Governance: Setting Risk and Collateral Parameters

Decentralized governance ensures that Deryxion evolves in line with community needs rather than centralized control .

Key governance decisions:

- Collateral whitelisting: which assets (Treasuries, invoices, real estate tokens, stablecoins) can back products.

- Leverage and LTV limits: maximum loan-to-value ratios and concentration caps per asset class.

- Oracle selection: choosing and weighting data providers for off-chain inputs.

- Strategy approval: whether new product types or strategies meet quality and safety standards before being offered to users.

- Treasury management: funding audits, integrations, grants for tooling, and insurance reserves.

Token holders can delegate voting power to risk committees or domain experts (quantitative analysts, DeFi veterans, RWA specialists) to ensure informed decision-making. This hybrid model balances decentralization with technical expertise .

Risks and Limitations

While Deryxion aims to offer safer, more transparent DeFi yield, significant risks remain :

- Market risk: underlying assets can lose value; even principal-protected notes depend on collateral maintaining sufficient value.

- Counterparty risk: RWA-backed products rely on off-chain entities (issuers, custodians) that could default or fail.

- Regulatory uncertainty: tokenized securities and derivatives face evolving regulations; compliance requirements may vary by jurisdiction.

- Smart contract risk: bugs, exploits, or oracle failures could compromise product integrity despite audits.

- Liquidity risk: some structured products may have limited secondary markets, making early exit difficult or costly.

Deryxion mitigates these through rigorous audits, conservative initial leverage limits, diversified collateral, phased rollouts with volume caps, and transparent communication about worst-case scenarios. However, users must understand that no protocol can eliminate risk entirely .

Roadmap and Future Vision

A sensible development path for Deryxion balances innovation with safety :

Phase 1: Foundation and simple products

- Launch core contracts for structured notes and derivative vaults.

- Start with low-complexity products: Treasury-backed fixed yield, simple call/put spreads.

- Onboard initial strategy creators and conduct limited beta with volume caps.

Phase 2: Expand product range and integrations

- Add more complex structures: autocallables, barrier options, multi-asset baskets.

- Integrate with major RWA tokenization platforms and DeFi yield aggregators.

- Launch governance and begin decentralizing parameter control.

Phase 3: Institutional and DAO adoption

- Partner with DAOs, protocol treasuries, and institutional DeFi desks.

- Offer customizable white-label structured products for specific communities.

- Implement advanced risk analytics and scenario modeling tools.

Phase 4: Global structured finance layer

- Position Deryxion as the default on-chain infrastructure for transparent derivatives and yield products.

- Enable composability: other protocols can build on Deryxion’s primitives.

- Foster a marketplace where strategy creators compete on track record and innovation, driving continuous quality improvement .

The long-term vision is for Deryxion to democratize access to sophisticated financial engineering—making strategies once available only to institutional clients accessible to anyone, anywhere, with full transparency.

How Users and Protocols Can Get Started

For retail investors:

- Research available structured products on Deryxion’s platform, comparing risk levels, underlying assets, and historical performance.

- Start small: allocate a portion of your portfolio to test a product’s behavior across market conditions.

- Monitor positions via on-chain dashboards and adjust based on changing risk appetite.

For DAOs and treasuries:

- Identify idle treasury funds that could benefit from structured yield.

- Propose custom product parameters aligned with community risk tolerance and strategic goals.

- Work with governance or specialized strategy creators to deploy DAO-specific structured notes.

For strategy creators and quantitative teams:

- Stake Deryxion Tokens to qualify as a strategy creator.

- Design and document a structured product with clear risk parameters, payout formulas, and stress tests.

- Submit for governance review and community feedback; once approved, earn fee share proportional to assets under management and performance .

By aligning incentives across users, creators, and token holders, Deryxion Token offers a path toward sustainable, transparent, and real-world-backed yield in DeFi—without sacrificing the openness and composability that make decentralized finance revolutionary.